The Face of PACE … Is It Right for Your Business?

What IS it, and why should I consider the program?

The PACE Program:

After the Great Recession, the PACE Program was funded by the private sector — and adopted on a case-by-case basis — by local governments modeling the national initiative. The Program enabled residential or commercial property owners — with challenges accessing capital — a way to finance energy-efficient improvements or needed repairs with no money down, using their home or property as collateral. Repayment of the ‘loan’ was made on an annual basis with a non-ad valorem tax assessment or lien on the property.

In other words: When the tax bill is due each year, so is a lump sum payment on the new roof, new windows, solar panels or new HVAC system.

In Flagler County, the Florida PACE Funding Agency (FPFA) introduced the PACE program for residential property owners in 2012, expanding the opportunity to commercial property owners through the Florida Resiliency and Energy District (FRED) in October 2021.

“PACE programs provide an alternate method of financing, approved by Florida Statutes, for owners to finance certain energy efficiency and wind resistance improvements to their property. Improvements may include HVAC systems, insulation, window replacements, solar energy panels, as well as hurricane hardening. There are 126 residential property owners in Flagler County enrolled in the Florida PACE program,” said Dolores Key, economic development manager for Flagler County.

“FRED PACE provides financing improvements to commercial/industrial projects. Unlike PACE in other states, Florida Statutes allows this financing mechanism to apply not only to major renovations in existing structures but also to new construction, retroactive refinance and Greenfields,” she said.

How can it help my existing business or commercial property?

Among the approved lenders in the C-PACE program servicing Flagler County is PACE Equity.

The Central Florida equity firm is not only working to provide innovative financing solutions for projects by helping build a more streamlined capital stack, but they also offer a better rate on capital for projects that meet CIRRUS Low Carbon specifications.

Verified independently by the New Buildings Institute, the ESG (green and sustainable)-based financing model is deemed “a unique program that achieves the status and benefits of a green building matched with financial benefits.”

In other words: If you are considering a construction project, it pays to incorporate sustainable, environmentally friendly options into the design, construction or upgrading of your property.

But take note, “in order for PACE Equity to be involved, there has to be an improvement to the property, which increases the collateral value. After the project, it is a more valuable building with lower long-term operating costs.”

“An energy study is required to qualify for PACE Equity financing and will quantify the utility savings and other benefits of the improvements,” says PACE Equity collateral.

St. Johns County added the C-PACE program in 2021, citing projects across the state of Florida in support of the addition.

C-PACE projects have included providing between $4-5 million of a $25 million construction project for wind resistance and energy efficiency upgrades to an assisted living facility in Nocatee, Florida; impact windows, impact roof and elevators, a $527,860 project financed over 25 years for the Southern Oaks Rehabilitation & Nursing Center in Pensacola, Florida; HVAC Chiller replacement financing for $634,995 spread out over 30 years for the Hilton hotel in Ocala, Florida; and roof replacement on a commercial building in Coral Gables, Florida, for $25,000.

What else can I do with C-PACE money?

Brownfields. It seems like nobody is talking about those anymore. What’s the tie-in? As we strive to make conservation a priority, rehabilitating previously used properties designated as brownfields is not only an environmental win for a community, it recycles the property for new uses and new economic development opportunities.

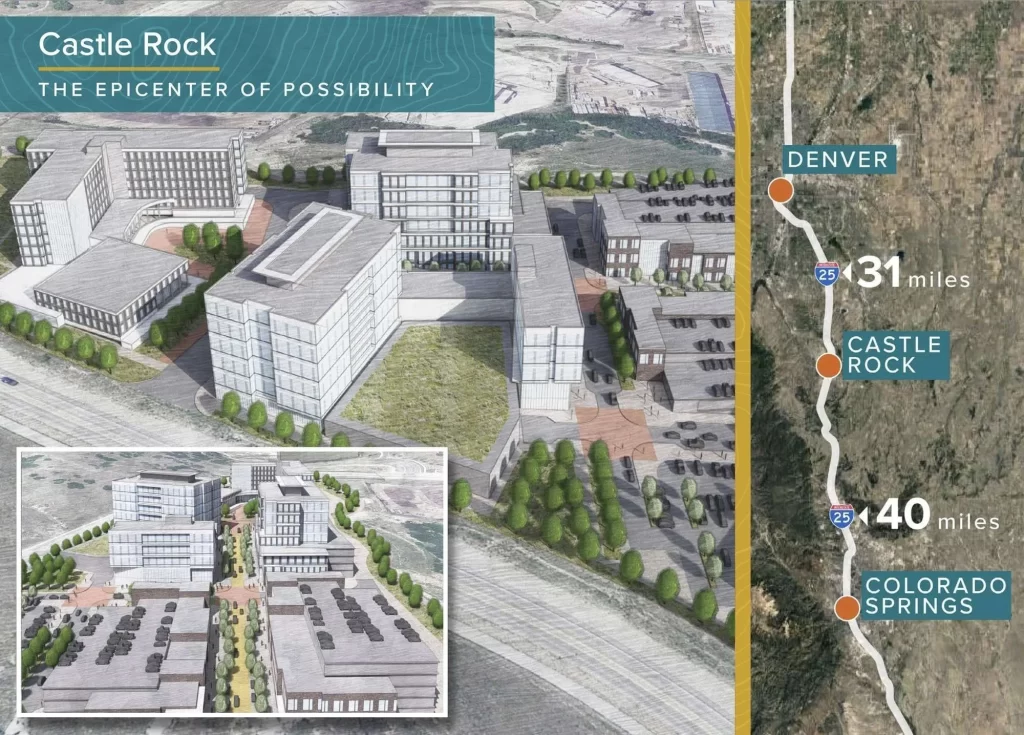

Redevelopment of idle brownfield sites like Miller’s Landing in Castle Rock, Colorado, using C-PACE as part of the funding package, has ensured the energy-efficient, mixed-use development can move forward.

Touted as a ‘tremendous tax revenue generator for the Town,” in a March 2021 news release by Castle Rock officials, the development will include ‘an exciting, dynamic town center that mixes high-tech businesses with vibrant retail, entertainment, hospitality and outdoor recreation opportunities.’

The Take Away: C-PACE dollars can help close funding gaps on commercial projects assisting with the transition from outdated infrastructure to new, energy-efficient buildings and renewable energy technology. And, it’s important to understand the pros and cons of the C-PACE program. Visit www.energy.gov/eere/slsc/property-assessed-clean-energy-programs to learn more about the program options and details.

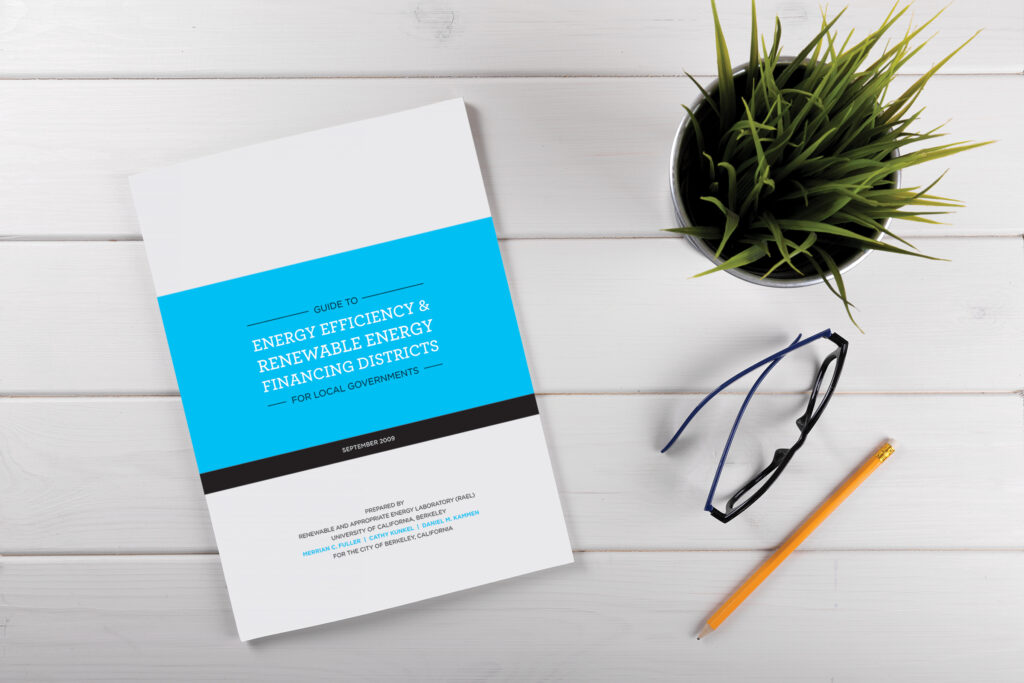

Started in 2009 and based on the publication “Guide to Energy Efficiency & Renewable Energy Financing Districts for Local Governments” from the University of California, Berkley as a way to accelerate a clean energy, carbon-free society, the Property Assessed Clean Energy (PACE) program was developed as a way to help homeowners/residential properties (R-PACE) and commercial property (C-PACE) owners make needed upgrades, repairs or eco-friendly, ‘green’ improvements.