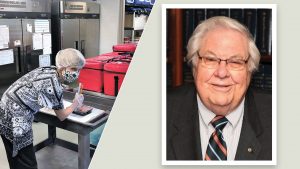

by John Guthrie

John Ferguson is a Partner at Cobb Cole Attorneys at Law. Mr. Ferguson has 30 years of experience and practices in the areas of merger and acquisitions, business organization and transactions, franchise law, commercial finance, international law, and general corporate and contract law.

Suzanne Forbes, CPA, is a Managing Partner with Jame Moore & Co. With more than 30 years of experience in the accounting industry, Ms. Forbes specializes in accounting, tax and business consulting services. She is the managing partner and also leads the Real Estate Services Team.

1. As you think about the importance of sustaining a business over time, what guiding principles should entrepreneurs be thinking about from a financial/ legal point of view?

John Ferguson: Fiscal responsibility is the most important component in starting and sustaining a business. In my opinion, all aspects of your business survival and success flow from fiscal responsibility. Setting reasonable liability protection measures is part of the fiscal responsibility because the costs arising from not setting reasonable liability protection measures can (and often do) result in business failure. Those reasonable liability protection measures include setting sound operating procedures for the protection of your workforce, vendors, and employees and include setting reserves to cover unexpected liabilities and maintaining proper types and amounts of insurance coverage (while not overpaying or paying for unnecessary coverage). The setting of reasonable liability protection measures is an on-going process that grows and changes with the growth and change of the business. With sound fiscal responsibility, a business can focus on the business’ ultimate goals, whether it’s solely profitability (which is definitely okay) or any other social causes which are important to the stakeholders (e.g., employee empowerment or betterment or community endeavors) … without fiscal responsibility, your business may not be around to focus on those social causes or will not have the resources to impact any social causes.

Suzanne Forbes: The saying cash is king is true. Successful businesses are able to forecast and manage cash flow at the highest levels. The process has to start with sales forecasts and related costs of production. The more growth the company is experiencing, the more working capital is needed. For example, if expenses have to be paid within 15 to 30 days of incurring them, and revenue from those expenses takes 30 to 45 days to collect, there is 15 to 30 days of expenses that the company has to finance.

2. Are there financial/legal issues entrepreneurs typically overlook?

JF: Yes, all day – every day. No business plan can address all potential financial and legal issues that a new or existing business may face. But if a future business owner does not take an honest look as to their business plan, the risk of failure increases exponentially. Taking an honest look as to your business’ place in the future market place, who the realistic patrons will be, what they will be willing to pay, what competition that you will have and how you will get your brand messaging delivered (rather than assuming that “everyone will love my idea” and winging it) will enhance the chance of success exponentially.

SF: Financial controls over who has access to funds coming in or out of a company is often overlooked. There have been many high-profile thefts that have occurred in business within our community. Anytime a theft occurs, the owners/executive management say they trusted the person. My response is if you didn’t trust them, you wouldn’t have kept them in the position they were in. Trust but verify!

3. With change and disruption as constants, where should entrepreneurs focus to sustain and grow their businesses?

JF: The question lays an excellent predicate – change and disruptions are constants. In the business plan, the owner should identify what the business’ core aspects of what will make the business successful and grow. If your product is ordinary but the services will set the business apart from its competition, focus on that service until you determine that you were wrong, and the patrons are not willing to pay for the service and then focus on changing the product. If your products or services are ordinary, but your marketing and social media presence will set our business apart from its competition, then focus on the marketing and social media presence, until you learn otherwise and then be prepared to change. Setting goals and thresholds to meet, so that if you are not meeting those goals and thresholds, you will know to reassess. The constant is change. You need to be prepared to change based on outside changes and disruptions.

SF: Businesses must have the resources to survive a downturn with either reserves or borrowing capacity. Leverage is necessary to grow a business, but if it is too highly leveraged, there is no room for fluctuations, like what we saw this last year.

4. Good advice is like gold. Who should business leaders have in their “cabinet” to grow and thrive?

JF: The members of the business cabinet will depend upon the nature of the business. However, as to base cabinet members that apply to virtually all businesses, I would recommend legal, accounting, insurance, and social media experts. As a business grows, the next cabinet member that will help a stakeholder to build a business would be human resources and/or payroll services expert. Similarly, as a business grows, bringing on a banker or financing source may allow the business to maximize its growth opportunities.

SF: Trusted advisors, including CPAs, Attorneys, Financial Planners and Mentor: these people will tell you what you need to hear, not what you want to hear. Some conversations are not easy.

5. Does every business need strategic plan and if so, what length of time should the plan cover and how often should the plan be reviewed?

JF: I recommend that all business owners invest the time to create a business plan. Drafting a business plan is a process that forces the future owner to consider issues and contingencies that may have been overlooked. While drafting the business plan, being open-minded and willing to change your “vision” or change your “baby” if a change is needed is paramount. A business plan is a living and breathing document but it’s also not something that changes daily with daily fluctuations in life and business. How often a business plan should be revised depends upon how successful the business is doing. However, at a minimum, it should be reviewed annually (maybe at an annual meeting of the owners, directors, or managers of the business).

SF: Business plans that are created and put in a drawer do no good for anyone. Instead, we recommend a strategic plan which ties financials projections to the plan milestones. The two should integrate. High level financial projections should be prepared looking out 5 to 10 years. Detailed projections should be for the next 1 to 3 years. These projections should be updated annually in connection with the strategic plan.

Another very important piece of a successful business is to have a well-documented transition plan or contingency plan. Often when I ask a business owner/CEO about their exit strategy, they don’t have one. Strategies could include a sale to a third party, to employees or family. It is never too early to start considering your options.

6. Speak to the importance of recruiting, hiring, retaining employees and how this can impact sustainability.

JF: Not all businesses are dependent upon employees in today’s greater electronic-based businesses. But for those that are reliant on a workforce, finding and maintaining a qualified, educated, trained workforce is a critical component of your fiscal responsibility (see above). Spending time, energy and money on already employed qualified, educated, trained people is almost always cheaper than spending time, energy and money on locating, hiring and training new personnel.

SF: Currently, the common thread among business owners is they can’t find qualified people. Building a pipeline of qualified people has become as important as a customer pipeline.

7. Please share your personal philosophy on sustaining your own business.

JF: In no particular order:

Do unto others as you would have them do unto you. Treat people as you want to be treated when you’re their employee, their vendor or their customer.

Do as you say. Your reputation is one of your biggest assets. It can also be one of your biggest liabilities if you’re not careful.

Hire good people who share good common goals, values and work ethics and then treat them like they’re equals and not employees.

Money is important but it’s not everything.

SF: Succession planning is critical to sustaining our firm. Many professional service firms focus on the original technicians that started the business and overlook the training and development of their future leaders. Our philosophy is to continually advance new leadership throughout the firm, which keeps us young, nimble and growing.

8. If you have one piece of advice what would it be?

JF: Be realistic. You may not be the first person to think of your idea. Your way of doing things may not be the best. Not everyone may care about your cause or idea as passionately as you. You may be wrong. There may be people smarter on certain issues than you. There is no shame in failing but ideally failure only comes after realizing, adapting and attempting to change to avoid failure.

SF: Businesses that last have built solid systems, which can operate independent from a single person. Too many business owners pride themselves on saying the business couldn’t function without them. My response is, “all you have created is an income stream and not a business.” Well-documented systems and a strong leadership team that can tackle an ever-changing operating environment is critical to business sustainability.